What do we mean by “Tax the Land”?

Taxing Land is at the heart of what makes Georgism that extra special blend of socialism and capitalism that appeals to luminaries of the Left and the Right such as yourself. But what do we mean by “taxing Land”?

Property = Land + Improvements

The words “property”, “home”, and “land” are often used interchangeably in common speech. For example, when someone says “All of my savings are tied up in my home”, they technically mean that all of their savings are tied up in their Property.

As with the words “rent” and “Rent”, this interchangeability muddles things. So, to untangle things a bit:

An upper-case-P Property has two components:

The Land the Property sits on (i.e. the lot)

The Improvements that are made on that Land (i.e. the home or building)

The value of any given Property is some mix of Land and Improvements.

What determines Land values?

Experientially, we know that Land values differ greatly based on location. An empty field in the middle of New York City will cost a lot more than an empty lot in rural Kansas.

This is true even if the Land contains different structures. An office building in rural Kansas is likely still worth less than an empty lot in Time Square.

Why?

The empty Land in New York City is “more productive”. Does that mean the soil is better? Probably not! You can probably “produce” more crops in Kansas than in New York City. So what does it mean to be more productive?

The lot in New York City is surrounded by millions of humans - each possessing a dizzying array of skills and desires. In a city, proximity allows people to leverage their skills to serve those desires. A person living on a piece of Land in NYC could commute to the West Village and work as a cook at a restaurant. Or they could teach violin lessons out of their home and have many customers to choose from.

In a rural place, these opportunities are not as readily available. There just aren’t as many customers for meals or violin lessons.

The crucial thing is: Land’s value comes entirely from the community that surrounds it, not because of anything a given Property owner does.

What determines the value of Improvements?

Improvements can take many forms but usually land is improved by building structures. Better structures are worth more than lower quality ones. It’s relatively intuitive that a big, fancy building is worth more than a parking lot - all else equal.

Improvement value is determined by the hard work that goes into building and maintaining structures and improvements to the land. Unlike Land value, Improvement value is mostly created by the Property owner.

So what is a Land Value Tax?

The Land Value Tax is a tax on the portion of a Property’s annual income that comes from Land.

A Land Value Tax is NOT a Property Tax because it does not tax the Improvements or structures that sit on that Land.

Structural improvements are a good thing for society so Georgists don’t want to tax that.

By design, a Land Value Tax only captures the income from a property that is due to the community that surrounds it.

The Land Value Tax is in effect (but not technically) a rental fee from society to use a piece of Land. Think of it like a bridge or road toll. The user of the road owes a tax to use it.

However, unlike the road or bridge the government does not own the Land. The Property owner still owns it.

The LVT just sets a minimum floor for the amount of economic activity you need to generate to “use” a piece of Land.

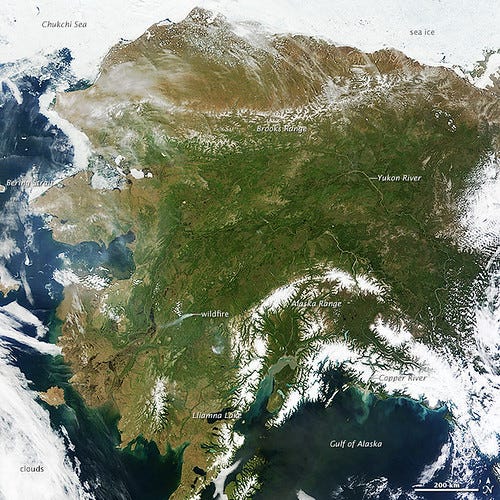

Norway and Alaska do something similar with their oil wealth. Since no human created the oil, it’s considered common property. Norwegians and Alaskans say to oil companies:

“You’ve developed an expertise in locating and extracting oil. We want you to do that; we just ask for a fee for the privilege.”

It’s a win-win because the more oil an oil company finds and extracts, the more the company and the citizens make!

Replace Oil Wealth with Land Wealth and you have the LVT. Citizens may say, “Hey entrepreneur, you have an expertise in creating wealth. We want you to do that in our city; we just ask for a fee for the privilege.”

This is also win-win because the better the entrepreneur uses the Land, the more money they and the citizens make!

How do you determine the Land Value Tax?

We need 3 things to calculate an approximate LVT for a Property:

1. The purchase price of the Property. This is relatively straightforward: what does the market value the property at?

2. The Land Share. That is, what percentage of the Property value is due to Land. There is plenty of debate about this but most peg the Land Share is between 50% and 81% of a given piece of Property’s value. If you want a deep dive on this topic, check out this article by Lars Doucet.

3. The Capitalization Rate. The capitalization rate is the annual income that a property can generate in a year divided by the purchase price. A $1M property that generates $100k per year in rent would have a 10% capitalization rate ($100k/$1M).

There are a range of estimates for what this should be but it’s typically between 5% and 10%. Another way to think about this is that a property with a 5% capitalization rate will pay for itself in 20 years (e.g. a $1M property with a 5% generates $50,000 per year. And $1M/$50,000 is 20 years).

Wait, but can we actually assess this number realistically?

Savvy readers are starting to have a lot of questions: How do we accurately determine the split between Land and Property values? Could shady land assessors scam the system? How do we ensure this is accurate and fair?

Getting into the nitty gritty of land assessment is out of the scope of this article. (If you want to dive in, check out this article about Land Assessment by Lars Doucet.)

Instead, I want to focus on three things:

1. We already assess Land values today

Property owners know that we already assess Land separately from structures and Improvements. You can check your property tax bill to see this. There are even some ideas around letting people assess their own land! Check them out here.

2. We don’t need to be perfect

We can improve the LVT rate over time with trial and error. And as we gain confidence in our theory and methods, we can adjust the rates accordingly. Most Georgists don’t actually want a 100% LVT. They prefer an 85% LVT in order to account for any mistakes in assessing land values. If you want a larger margin of error, you could even do 75%.

We also don’t need to go all in on Georgism from the get go! We could simply increase the percentage of the property tax that is due to land and offset it with a corresponding drop in the "Improvements" component. This would allow us to incrementally test whether these principles play out in the real world.

3. Gaming the system isn’t impossible but is more complicated than what we have today

Our current tax system is quite complicated! I feel this every time I have to log into TurboTax to figure out what the hell I owe each year. And my taxes are simple! I don’t own a home.

Our current system offers myriad loopholes for rich people to hide from taxes. But you can’t move your Land into a Swiss bank account.

Also, all land values would be public record. So if anything shady was happening it would stand out!

What does it look like in practice?

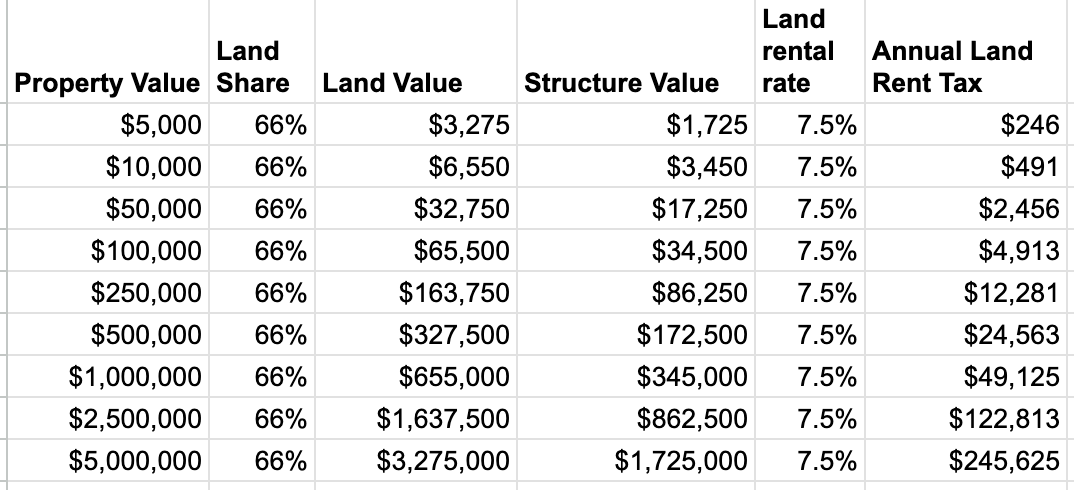

Using our basic heuristics, we can actually calculate the tax you might owe on your property right now! If Land Share’s are between 50% and 81%, let’s split the difference and call it 66%.

Since the debate ranges between annual income rates of 5% and 10%, let’s split the difference and use 7.5%.

Here is a table (again borrowed from Lars):

First, this doesn’t look too bad to middle class and lower income folks.

Two teachers living in San Francisco make about $120,000 combined. They pay about $40,000 in rent and $40,000 in taxes totaling $80,000. Under an LVT, they would pay $50,000 total for a $1M home.

Second, recall that this is the only tax that anyone pays! So before you protest about paying $120k in taxes for your $2.5M home, recall that you would pay no income or capital gains taxes. Run your own numbers and see if you’re worse off.

Third, remember that by removing the speculative element from the real estate market, we should expect Land values to drop, which would reduce the amount of tax you end up paying.

Fourth, Georgism prescribes a Citizen’s Dividend so that you are actually getting some money back each year in either a check or in services like schools, roads, etc.

Why an LVT?

A Land Value Tax merely taxes the annual income that is due to Land, while taxing none of the income that is due to Improvements.

But why is this better?

Recall Henry George’s paradox of Capitalism: when a community gets richer, rising Land values create poverty. A Land Value Tax fixes this paradox because rising Land values benefit everyone. Not equally mind you; there will still be entrepreneurs and richer folks based on ability and effort.

But an LVT creates an ever rising floor. As Land appreciates, tax revenue grows correspondingly for redistribution and services.

An LVT also creates new incentives which lead to:

Lower rents due to more investment in structures to their most efficient use

Lower land prices due to reduced speculation

Protection from Booms and Gentrification