Why do we never have enough for public services?

Have you ever been filling out your ballot when a little devil pops up on your shoulder and says, “Hey, didn’t we just vote to double the budget for that last election? And yet that problem is kind of getting worse?”

As your hand subconsciously glides towards the box that says No, the good liberal angel appears and reminds you that “sometimes the government works in mysterious ways” and “we must make sacrifices”, and guides your hand to Vote Yes on Measure A.

Or maybe someone sent you this viral video titled “Blue States, You’re the Problem”. You triple checked that it was sanctioned by the New York Times before clicking and nodding along but you felt so guilty about it you had to take a shower afterwards?

Here in San Francisco, I merrily voted for every bond measure to fund City College and public transit. But I’ve watched as each of these services start to feel qualitatively worse. Our budget for homeless services went from $157M in 2011-2012 to $364M in 2019-2020 while most San Franciscans I know acknowledge what feels like a lack of progress.

I find this puzzling - wouldn’t you expect that as we spend more money on problems, that those problems would get better?

Supply Side Progressivism

Supply-side progressivism offers an answer: if you subsidize demand without increasing supply, things just become more expensive.

With the best of intentions, we decided that everyone should go to college. To facilitate this, we started to subsidize college tuition with generous loans from the government.

Universities are not technically fixed in supply, but they are in practice. There seems to be an unwritten rule that a university must be old to be prestigious. So until we invent time travel, the supply of prestigious universities is effectively fixed. And prestige aside, starting a new university is hard and expensive, keeping supply restricted.

But since there was now more demand for the same supply of colleges, the price just went up - increasing 4x even adjusted for inflation.

The goal of Progressivism is to make The Good Life (education, electric cars, healthcare, child care, and clean energy) more available and affordable to everyone. Supply-side progressivists recognize that for too long the movement has been focused on subsidizing demand without much thought to increasing supply. And that has made our affordability problems worse.

Government spending subsidizes demand for Land

This is all music to the ears of Georgists who have been talking about supply problems since the 1870s. Since the supply of Land is definitionally fixed, any increase in demand for land raises prices.

It turns out that government spending tends to increase the value of Land. When a government builds a new road, bridge, or invests in something like better public schools and parks (all good investments!) more people will want to live there. That increased demand drives up the price of Land.

Liberal economist Joseph Stiglitz, actually pointed this out with what he called The Henry George Theorem (a nod to George himself!). The Henry George Theorem states (among other things) that government expenditure drives up Land prices. This means that in effect, government spending (even the best kind) is a subsidy to Land.

Let’s say your city raises a bond to fund better public transportation. This makes your city more desirable to live in: more workers can commute more easily, people don’t have to worry about parking, the air is cleaner, etc. But this makes the city’s Land more valuable, driving up rents.

The bus drivers who live in the city now need to pay those higher rents. They strike for more money, or cut a deal with a friendly government to raise salaries and soon, the transit department is in the red. So another bond needs to be raised to fund the system, or quality of service will degrade. Rising land prices make the government’s dollar go less far over time.

Supply-side progressivists may recognize this dynamic: we’re increasing demand through government spending without expanding supply of Land which is fixed. This is why it seems like we never have enough!

Pouring Fuel on the Fire

The traditional playbook when things get too expensive is to raise taxes and start subsidizing things. But this is like trying to fight fire with gasoline.

San Francisco created what was at the time an innovative ~4% tax on restaurants that goes to paying for healthcare for restaurant workers. A noble cause indeed! But the method of funding turns out to be flawed.

First, taxes on income and sales cause less wealth to be created. So there is a smaller pool of wealth the city can tax.

The 4% tax on restaurant meals actually leads fewer people to eat at restaurants which means that there are less tips and wages for restaurant workers to make. Some restaurants will have to close their doors due to the decreased demand. (Also this kind of tax is regressive - rich people don’t mind paying the 4% fee, but middle and lower-income people will actually make the decision to eat out less when prices rise).

Second, you are taxing the wrong people and exacerbating the problem!

Rising Land prices are already squeezing Labor and Capital. Adding income and sales taxes gives them less money to spend on shelter.

But by then spending that tax revenue on government services, you are in effect subsidizing Land prices. So you are literally feeding the problem by sourcing government revenue by income and sales tax.

Even the most enlightened and efficient and effective government won’t be able to get around this. In fact, it gives us reason to believe that the better your government, the more expensive land is going to get!

So what’s to be done?

A land tax is different

It turns out there is one type of tax that doesn’t run into this problem: our old friend the Land Value Tax! Why?

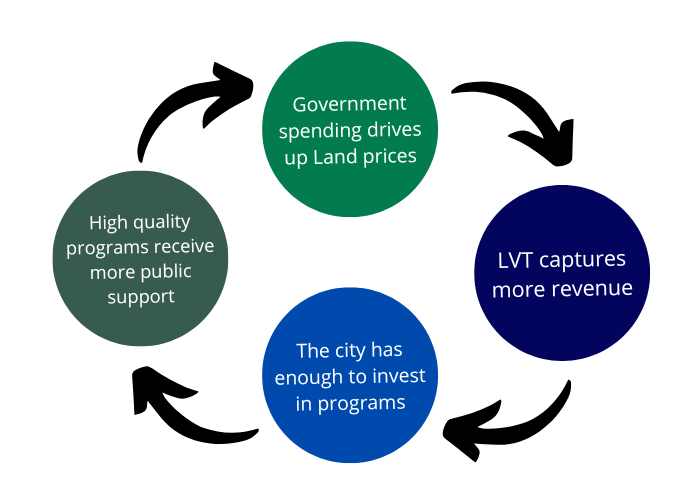

It’s actually quite simple. Government spending leads to higher land values; higher land values mean more tax revenue is captured via the Land Value Tax; and there is now enough to spend on generous programs.

We now have an infinite loop of automatically rising tax revenue. Whereas before, rising Land prices made every dollar of government spending go less far.

Let’s say for example we replaced the 4% Healthy SF restaurant tax with an increase in Land Value Tax that raises the same amount of revenue (in San Francisco, this would be a fraction of a percentage point).

Restaurant meals would get 4% cheaper. So more people can afford to eat out. Which means there are more jobs, tips, and wages available to restaurant workers. Who now have more money in their pockets with which to dine out. Which sets up a virtuous cycle!

But we are still raising the same amount of money through the Land Value Tax so we can still subsidize healthcare for restaurant workers!

More restaurant workers will want to move to San Francisco when they hear about the plentiful jobs, tips, and wages - not to mention the subsidized health care!

This influx of workers will cause Land values to rise. However, that’s okay because the city’s tax revenue rises in a corresponding fashion. So the healthcare program still has enough revenue to fund healthcare for the new workers.

You may be thinking, very clever, but won’t all of these people moving to the city cause rents to go up negating the benefits of this scheme? And here is the miracle of the Land Value Tax - they won’t! Why?

Well, who pays the rising taxes? Landlords. And as we’ve covered before, Land taxes cannot be passed onto tenants.

If a landlord tries to raise the price of Rent to cover the tax, the demand for their land goes down and they make less revenue. But the tax still has to be paid. So the only way they can make more money is in fact by building more units to generate more revenue to cover the tax. And this causes rents to stay relatively stable.

There is nothing inherently wrong with government spending, we just need a new funding source

Blue cities are struggling to deal with some major problems exacerbated by rising land values. Henry George’s cautionary prediction from the 1870s has come true: our richest cities have some of our biggest challenges - rising inequality, underfunded schools, not enough childcare, rising numbers of homeless people, and the Rent is Too Damn high.

There is good news and bad news. The bad news is the traditional playbook won't work to solve these problems - it will only make them worse.

The good news is there is nothing inherently wrong with government spending! Government can help many people live better lives. We just need to make sure that the government is getting its revenue from a source that does not exacerbate the problems caused by a fixed quantity of Land.

If you share my belief in the government’s ability to help people, then please understand this: the types of taxes we advocate for matter a great deal. If we can advocate not just for higher taxes, but for the right taxes, we can start to make a dent in some of our most intractable problems.