How Georgism can end inflation and the boom and bust cycle

We recently made a bold prediction: land speculation is going to lead to an economic crash in 2026!

But is there any way to prevent this from happening?

Georgists say yes! In fact, a Land Value Tax will end the boom and bust cycle altogether as well as the inflationary policies used to prevent them.

What is inflation?

Inflation occurs when the amount of money in an economy rises without a corresponding increase in the wealth of that economy.

The Roman Empire ran into this problem in the 3rd Century. Wanting to finance more projects, but not quite having the coins, Roman administrators came up with an ingenious plan:

“Coins are made of silver right? What if we just dilute the amount of silver in our coins and thus create more coins?” The Romans did not understand the concept of inflation and they were surprised to learn that instead of being wealthier, prices simply started to rise.

The same thing happened in Europe in the 1500s and 1600s. When the Spanish started bringing back gold and silver from their colonies in the Americas, they assumed all of this gold and silver would make them rich! But in fact, it just led to higher prices because more money was chasing the same amount of goods and services.

By the 1700s, Adam Smith had begun to understand the theory of inflation and the idea that you cannot just print money and be richer - it simply makes everything more expensive.

Henry George, writing in the 1870s, was very concerned about the boom and bust cycle, but curiously had little to say about inflation because it wasn’t really a problem.

In Capital in the 21st Century, Economic historian Thomas Picketty points out that 19th century authors like Jane Austen were so accustomed to stable prices, that they would frequently refer to specific numbers for salaries and prices in their books. Whereas today, authors expect a certain amount of inflation and know that specific references to prices (e.g. “his salary was $100,000”) won’t age very well because in 20 years $100,000 will have a very different meaning for readers. Most of us pretty intuitively understand this.

But if we figured out inflation in the 1800s, why is it such a big deal now? Why is the Fed always battling it or worried about it?

Inflationary policy is used to delay busts

Modern inflation is caused by policies designed to delay busts in the debt cycle. No one likes an economic downturn. So governments and central banks are willing to risk a little inflation if it helps them avoid a crash.

Inflationary policies can take a number of forms: fiscal stimulus, quantitative easing, maintaining low interest rates - all the stuff you hear about in the news.

Each of these levers is slightly different, but at the end of the day inflationary policies are akin to the government printing money.

Printing money is helpful to the economy because it keeps credit flowing in the system and allows investors to take on debt for new ventures. This is core to how the economy grows.

But remember that there is good debt and bad debt.

When debt is used to buy productive assets, it’s good. If you take out a loan to buy a tractor, you can harvest more crops and make more income. You can then use that income to pay back your loan with interest. You have grown the economic pie through this productive use of debt and everyone is better off!

We want businesses to take out loans to generate new wealth. It’s good when biotech companies can experiment and fund R&D. Just as it’s good when a chef can get a loan to open a new restaurant downtown - creating jobs and delighting customers.

Debt is bad when it’s used to buy non-productive assets like TVs and fancy cars. These purchases do not generate new income with which to pay back the loan. Using debt to finance consumption merely pulls future spending forward into the present. You can do this for awhile, but at some point there is a day of reckoning.

Crashes occur when too much bad debt piles up and crowds out the productive debt.

Land and the boom and bust cycle

Georgists believe that land speculation plays a much larger role in crashes than most people realize. They are quick to point out that a lot of debt goes into buying real estate. In the US alone, about 75% of household debt is for home mortgages.

Georgists also point out that Land is not a productive asset, despite appearances to the contrary. Individuals can get very rich by buying, holding, renting and selling land. So at first glance Land looks very productive!

However, making money off of land value appreciation (i.e. land speculation) does not create new wealth. They are merely transferring wealth from one group to another.

Why is this so?

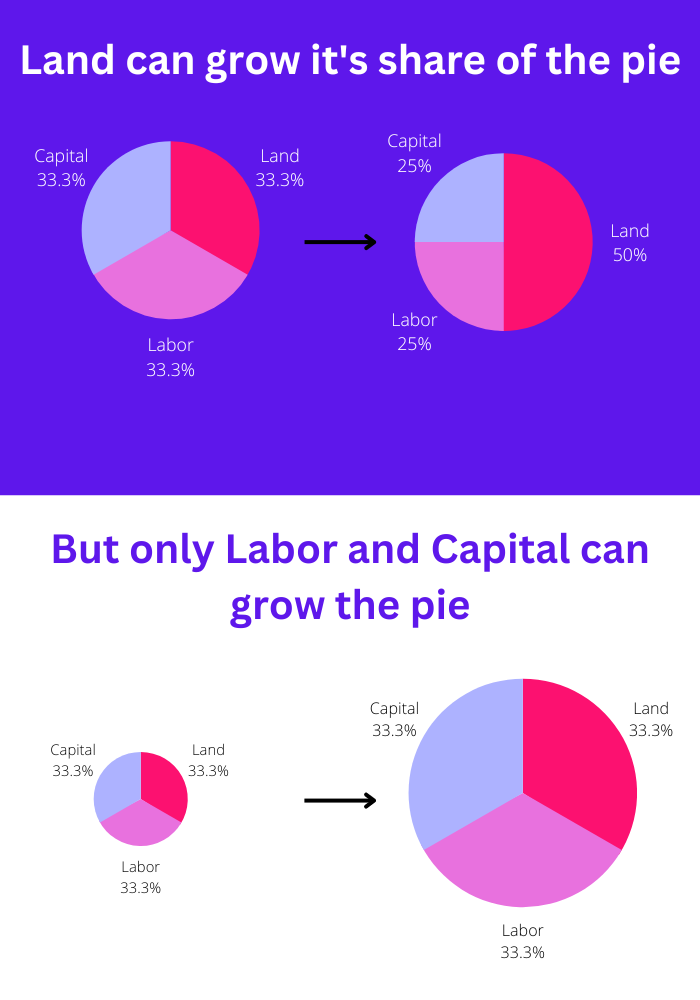

Labor and Capital are dynamic, so they have the ability to create net new wealth: a new vaccine or secret pizza sauce is new wealth that wasn’t there before and grows the pie.

But Land is a zero sum game because of its fixed supply. You cannot grow the supply of land.

The new wealth generated by Labor and Capital is chasing a fixed quantity of Land so overtime Land prices rise representing a transfer of wealth from Labor and Capital to landowners.

In fact, it’s somewhat analogous to the Spanish in the 1500s. Then, more gold was chasing the same amount of wealth which led to rising prices. In our modern economy, more wealth chases a fixed quantity of land - leading to rising Land prices.

Land prices soon rise to the point where most people need to take out loans to buy land. They do so amidst a chorus of people telling them their home is an investment. And it looks like an investment since people are getting rich off of real estate. But your home is a terrible investment.

This adds fuel to the fire because the financial system allows people to take on more debt to finance land purchases which leads to further rising prices.

But remember - Land is not a productive asset. So on aggregate, buying Land is more like buying a big screen TV with credit card debt rather than a tractor.

Economy-wide, all of this housing debt is just bringing future spending forward - eventually we must pay the piper. As Land prices increase, Labor and Capital can no longer afford to pay the prices the market demands. So they stop paying. The productive asset that you bought no longer generates as much rent as you thought it could and prices plummet. But the collateral for the loans was the land that was previously valued at high prices. This is what turns a burst in the real estate market into a financial crisis.

Inflationary policy is used to keep this going as long as possible by pumping “printed” money into the system.

But this is only treating the symptom - you can only kick the can down the road so long. At some point we have a spectacular crash like the Great Depression or the Great Recession.

How would a Land Value Tax help?

The heart of the problem is that Land looks like a tractor but is in fact a TV. People, governments, and central banks mistakenly believe they are creating new wealth, but they are not.

A Land Value Tax clears up this confusion. By taxing away Land’s income, it no longer looks productive.

If Land no longer looks like a productive asset, people are no longer willing to pay speculative prices for it. And they definitely are not going to take out loans to buy it because it will be obvious that they aren’t buying a productive asset.

They will still use debt - but they will use it to improve their land or to invest in businesses. This is akin to having a large chunk of the debt in your economy moving from unproductive purchases like TVs to productive purchases like tractors.

Since you are no longer using debt to pull spending forward from the future, there is no point at which “the music” stops. So you don’t have spectacular crashes anymore.

This would be a big deal! Instead of having periodic depressions and major recessions, we’d see a smoother upward trajectory in the economy. And it’s not simply about smoothing out the ride! When credit is fully diverted from speculative purchases of Land, it can now be fully unleashed into the productive part of the economy.

And when debt is used to finance productive assets, central banks and governments will have less incentive to prop up bad debt with inflationary policies.

Does this mean we’ll never have a recession again?

There are two types of crashes.

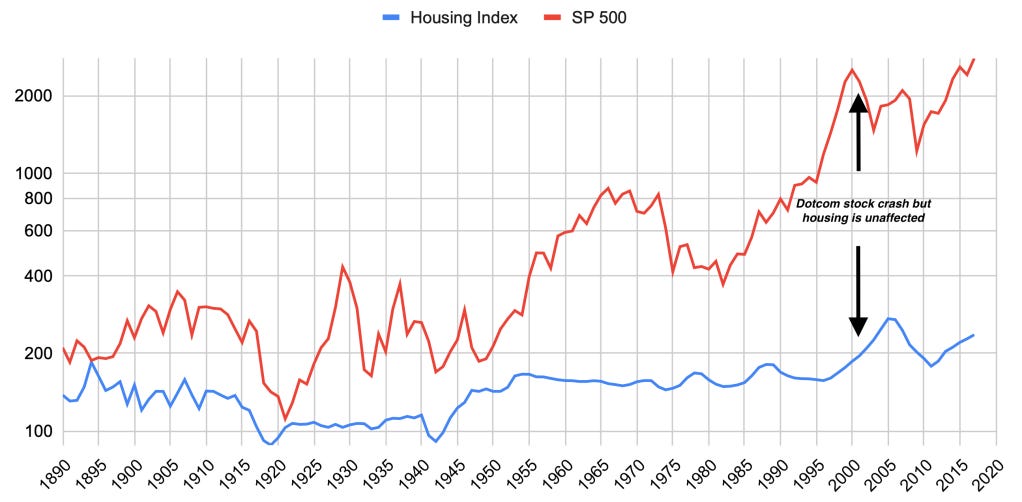

The first is your run of the mill stock market reset. This occurred after the DotCom bubble in 2001 and the Covid crash of 2020. It also happens in smaller ways like the 2018 dip. These are painful to people who believed that they were wealthier than they in fact were. But they aren’t deep and systemic the way the 1990 recession, the 2008 recession or what I fear the 2026 recession will be.

The second type of crash is a systemic crash in which all sectors of the economy collapse. Most recently this happened in 2008 when the stock market and real estate cratered. The real estate market cratered first causing widespread panic about the banking system which caused everything else to crash.

Georgism will not fix the first type of crash. Speculative bubbles will always be with us.

New ideas - whether they are Pets.com, Amazon, or Bitcoin - will generate hype. PE ratios will rise beyond what is reasonable. But these resets are actually self regulating because supply and demand are dynamic. As the bubble pops, supply of that speculative asset reduces and prices fall. Because new wealth is being created, and it’s mostly not financed by debt, the crash is mild and not systemic across the system.

When is the next crash coming and what can we do about it?

Writing this in 2023, we are 11 years into the 14-year property cycle. Which suggests that a bust is coming around 2026. I’m skeptical that we will act in time to avert this, but 2026 represents an exciting opportunity for Georgists.

When Land prices are at their bottom and people are reeling from another bust, Georgist ideas might be more feasible to implement.

During the 2008 financial crisis, Rahm Emanuel famously said that “a crisis is a terrible thing to waste.” But we did waste it. We passed all manner of laws to prevent the next crisis. But because we didn’t understand the role that land speculation plays in the boom and bust cycle, we merely treated the symptom without addressing the cause.

2026 can be different. If a rising chorus of voices demand treatment of the the underlying problem we avoid another trip on the merry-go-round of the debt cycle!