Will there be a housing crash in 2026?

They say that economists have correctly predicted 10 of the last 2 recessions. Well, Fred Harrison, a ~77 year old British economist, has correctly predicted the past 2! And he’s predicting the next one to be in 2026.

More technically, he predicted the past two housing crashes (more on that in a bit) with his theory of the “18 Year Business Cycle.”

What is the 18 Year Property Cycle / Business Cycle Theory?

At the start of the cycle, few investors are willing to buy property because they are still spooked from the Recession that ended the previous cycle.

But some intrepid investors see an opportunity in low real estate prices and start to buy again. This is the recovery phase.

After about 7 years, people get nervous. They think: “Prices have been rising for a while and didn’t we just have a housing crash a few years ago?” I thought this in 2015: things can’t keep going like this, can they? This is the “mid-cycle dip”.

But the fact that it’s a dip and not a crash, causes people to relax. They start saying things like “They aren’t making more land so housing prices always go up!” and “This time is different!” Your parents start to bug you about how you should buy a house already because you’re missing out! (Hi, mom and dad!)

This Explosive Phase lasts another 7 years.

But after 14 years, we reach peak irrational exuberance and there is a crash. A 3-5 year (average 4 years) recession follows as people lick their wounds.

And that’s how we get an 18 year business cycle: a 14 year property cycle plus a ~4 year recession.

Is there really a noticeable 18 year business cycle?

This is a pretty courageous claim and prediction! So the first thing I did was very quickly spot check his numbers.

I did some mental math:

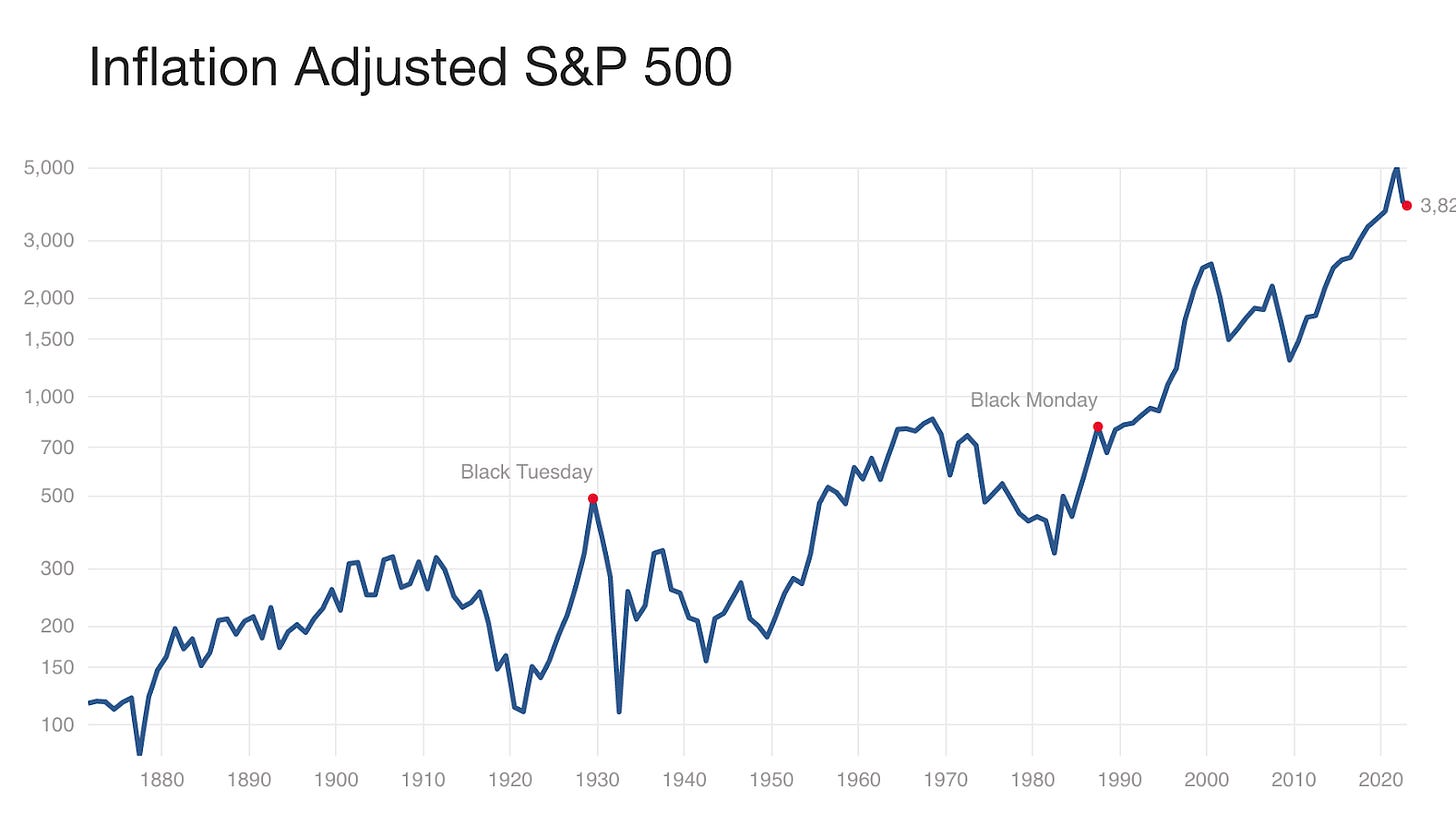

Let’s see…the last recession was the infamous Financial Crisis of 2008. It was caused by all of those terrible banks and their “subprime mortgages” and building all those houses in the desert. Sure, that seems like a “housing crash”.

Prior to that the DotCom bubble burst in 2000. But that’s only 8 years prior - not 18! And it wasn’t about housing at all! It was irrational exuberance about WebVans and Pets.com.

And the recession before that was in 1990 - only 10 years prior. Hmm this doesn’t sound right to me.

But then I remembered, he was predicting housing crashes not stock market crashes. So instead of looking at the stock market, I looked at housing:

I could see that there was a housing crash in 2008, yes. If we go back 18 years from there, we would expect a housing crash in 1990. And that is what we see. Housing dropped 6.41% in 1990 relative to 1989. It also kept dropping and didn’t start growing again until 1996.

But prior to that it’s less clear to me. The prior crash appears to be 1980, which is only 10 years before. If you call that the “mid-cycle dip” the prior crash is 1973 which is 17 years before 1990. But that kind of seems hand-wavy.

I don’t even know what to make of the 1960s. It seems like there was a dip in 1956 (17 years before 1973) but the 1973 index was below the 1955 peak still. Maybe all of that post-war optimism led to a housing glut that kept prices in check?

So what’s the verdict?

On the one hand, it still feels a bit like I have to squint to see this pattern and it’s not precisely 18 years each time. Also, the “mid-cycle” dip seems like a convenient way to explain away inconvenient data.

On the other hand, I do find it interesting that the DotCom bust did NOT have a housing bust accompanying it. Naively I would assume that stock market crashes would cause housing prices to fall. Fred Harrison’s theory, on the other hand, wouldn’t expect that because there is a separate property cycle that has its own rhythm.

Maybe this is what we also saw in 2020? The stock market lost about 34% of its total value in August 2020 due to Covid restrictions. Many were predicting housing to drop at that point as well, in particular as people fled cities and could work from anywhere! But what happened instead? Housing prices actually rose significantly in 2020.

Again, Harrison is yawning because we’re not at the end of the cycle yet.

So I would say I remain intrigued if not fully convinced.

Why do we have a business cycle at all?

Leaving aside predictions about the precise length of the cycle for a moment, isn’t it surprising that we have a business cycle at all? Why have there been crashes in the housing market every 15-20 years for the past 200 years? Wouldn’t we expect that since land is fixed in quantity, the price for it always goes up steadily?

Hedge fund bajillionaire Ray Dalio says that we have a boom and bust cycle because debt moves in a cycle.

People can borrow money (aka use debt) to do two primary things. They can:

Buy productive assets - like a tractor

Buy consumption - like buying a TV or a sports car

Dalio says “[Credit is] bad when it finances over-consumption that can’t be paid back”. Financing consumption with debt is akin to pulling future spending into the present. At some point in the future, you need to cut spending to pay back your debt. If you take out a loan to buy a TV, you’re not generating more income in the future to pay back the loan.

But Dalio says credit is “good when it efficiently allocates resources that create income so you can pay it back.” He gives the example of a farmer taking out a loan to buy a tractor.

The tractor allows the farmer to harvest more crops and generate more wealth. They can use that wealth to pay back the loan with interest and everyone is better off.

Crashes occur when the amount of bad debt starts to pile up and future spending needs to be curtailed in order to pay back debts.

According to Dalio, a Depression happens when people discover that their assets are not worth what they thought they were.

Here’s the big question though: is real estate a productive asset or consumption?

Dalio’s video doesn’t focus much on real estate specifically, though he does frequently use the euphemism “buying assets”. Curiously, the illustration used when he talks about buying assets is always a little Monopoly house.

How does the 18 Year Property Cycle fit in?

Let’s unpack assets a bit. When I think of “assets” I think of stocks and bonds, and I think real of estate. Stock and bond prices certainly ebb and flow. But I think most agree that stocks and bonds are investments in wealth generating businesses and are thus productive.

But again, what kind of asset is real estate? Is it productive like a tractor or consumption like a TV?

It seems productive because people make boatloads of money on real estate. But we have to recall that real estate is made up of two portions: Land and improvements.

It turns out that while improvements are productive (i.e. net new wealth), money spent on Land is not productive.

In fact, money spent on Land represents a transfer of wealth rather than a net creation of wealth. This is because Land is fixed in quantity - you cannot grow the pie of Land.

This means that all of the debt going to fund Land purchases, is more like taking out a loan to buy a TV rather than a tractor. Borrowers are pulling spending forward out of the future, without actually creating new wealth which will pay back the loan (with interest).

Since one cannot indefinitely pull spending forward from the future, at some point the music must stop.

Harrison’s 18 year business cycle posits that as more and more money gets soaked up by Land purchases, less is available to invest in productive assets. Eventually, people are unable to pay back their debts and a crash occurs.

All of this is obscured by the fact that for about 14 years, land speculation looks awfully productive. People are making millions and watching their houses rise in value, sometimes spectacularly. No one thinks they are pulling spending out of the future or bidding up a speculative asset. They’re investing in real estate which always goes up!

So Harrison’s (and Henry George’s) belief was this: land speculation makes a lot of debt in our economy look superficially productive. But in fact it is not and this causes us to have periodic booms and busts.

What is all of this debt being used for?

So is everyone buying proverbial TVs or tractors? Let’s do a very quick spot check.

According to the Federal Reserve Bank of New York, $12T out of $16.5T is for housing debt. Which means that nearly 75% of household debt is for housing.

McKinsey says that 68% of total global assets are for “Real Estate” with over 50% of the total Real Estate coming from Land. As a total, Land represents about 43% of all global assets - again not including the structures or buildings. Hat tip Lars Doucet).

And here’s one more spot check: A very high percentage of all bank lending goes to real estate (Again, hat tip Lars Doucet).

It does seem that an awful lot of the debt in the economy goes toward purchasing Land. This leads me to believe that Harrison’s interpretation of the debt cycle is correct.

So will there be a housing crash in 2026?

Your crystal ball is as good as mine! I do find it pretty plausible that there will be a housing crash in the next few years. And despite a massive uptick in housing prices over the past 2 years, housing is actually a lower percentage of household debt than it was in 2012 so we may just have started the “explosive phase” in 2020.

I also find it convincing that our next crash will be more of a systemic crash on the order of 2008 than a stock market dip like 2020 or 2001. As more debt goes to Land, a deleveraging may need to occur which would cause both housing prices and stock prices to fall significantly.

Regardless of the exact timing, I do think land speculation plays a large role in the boom and bust cycle.

Lastly, I want to commend Harrison and other Georgists for providing clear and specific predictions about what will happen in the economy based on first principles. Economists are notoriously bad and unwilling to make predictions about the economy and instead point to “animal spirits” as driving booms and busts.

As Tyler Cowen would say, big if true!