Medicare for All, but for Land

I have a conservative friend who loves the idea of “Medicare for All”. He feels that by removing the middleman (i.e. private insurers) we can actually get better healthcare at a cheaper price.

He pointed out that Georgism appeals to him for the same reason: by reducing the role of landlords as a middlemen, we can reduce the amount of tax people pay while ensuring that our public goods have sufficient funding.

How?

It turns out there are many efficiencies to be gained by combining “rent” and “tax” into a single bucket.

Let’s dive in with an example!

Two Teachers Living in SF

Picture two married teachers living in San Francisco. They make a combined salary of $120,000 per year. They pay 27% in federal and state taxes. Rounding down they pay $32,000 in taxes and take home $88,000 a year.

The teachers also need a place to live. This is San Francisco, so let’s assume they rent. The average for San Francisco is $3,397 per month or about $40,000 per year.

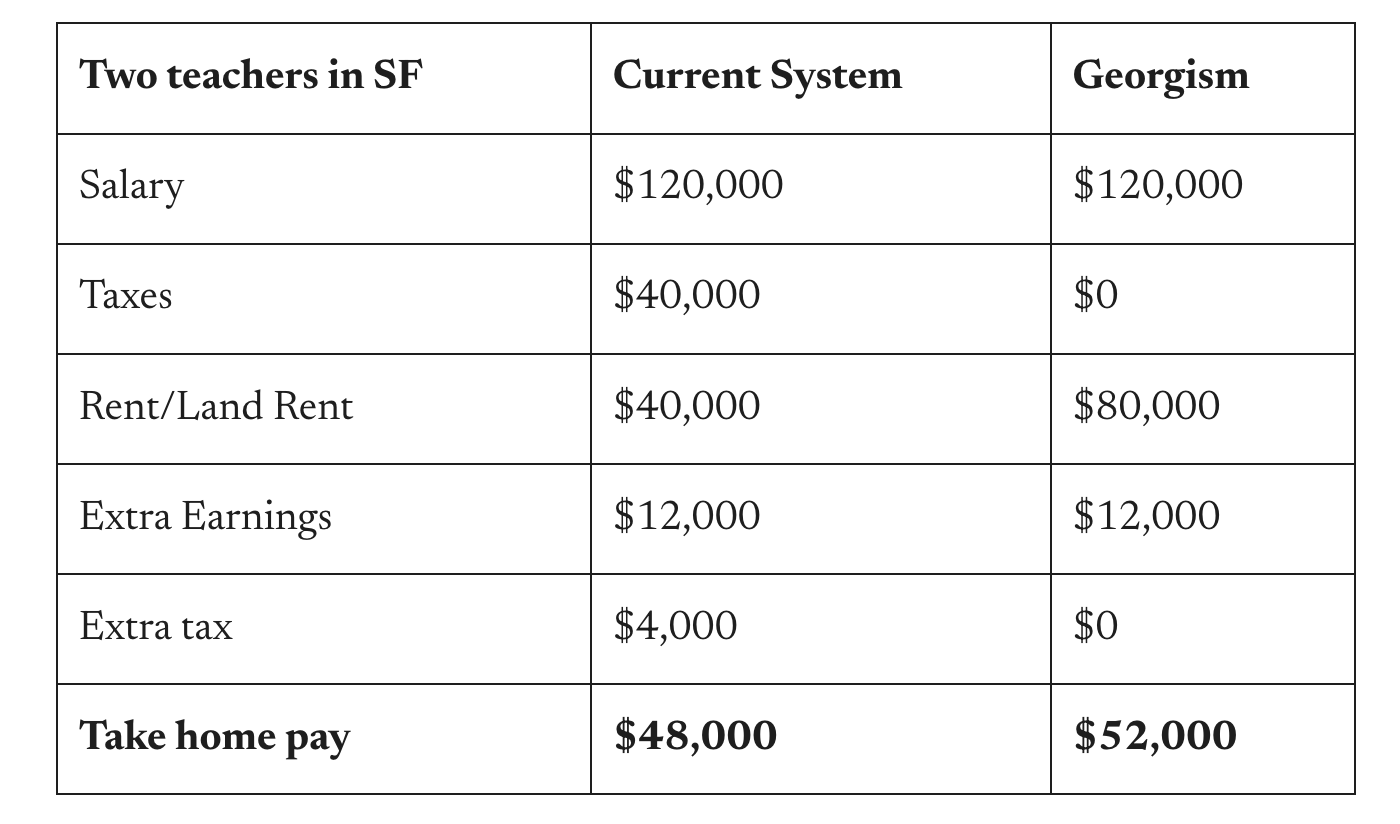

To keep the math simple and account for other taxes like sales tax, let’s round our numbers out and say the teachers spend a third of their income on rent ($40,000), a third on tax ($40,000), and keep a third ($40,000).

Georgism proposes that we replace all taxes with a single tax on the unimproved value of land. One way to think of it is that instead of paying taxes, you just pay “rent”. Another way to think of it is instead of paying rent, you just pay “taxes”.

In this example, the teachers would now pay $0 in taxes and $40,000 in rent.

While this seems good for the teachers, it seems a raw deal for the government. Fear not! The government is still going to get their $40,000. They will just tax the landlord.

But won’t the landlord just raise the “land rent” to $80,000 so that the teachers are no better off?

Yes, they will raise the rent, but the teachers will be better off. Why?

First, the maximum that the landlord can raise the rent is the total amount of the tax. This is because when a good is in fixed supply (which land is) you cannot raise prices above the market rate to offset the tax.

So at worst, the situation is net neutral for the teachers:

But notice a few big benefits!

First, life is way simpler! The teachers never need to file taxes again. They have a simple and transparent tax bill that they pay via rent to their landlord.

Second, notice that government revenue just doubled from $40,000 to $80,000.

The Citizen’s Dividend

Henry George wrote in the 1870s - decades before there was a federal income tax or the New Deal. Since there was no social safety net, he had a simple idea: what if we just redistribute the proceeds of Land Rent back to everyone via a “Citizen’s Dividend”.

This puts every citizen in the position of a landlord. When land becomes more valuable, their dividend increases.

Remember Land’s scarcity means that it always gets more valuable as population grows and technology improves - so the Citizen’s Dividend is always going up!

A lot has changed since George’s time. So the form of the Citizen’s Dividend might look different.

Should we distribute it directly back as cash (i.e. Universal Basic Income)? Should we make social security solvent? Should we spend more on schooling, roads, bridges? Should we use it to fund Medicare for All? Political junkies can rest easy that these debates will continue.

But there will be no debate that when booms cause land to become more valuable, every single citizen shares in the fruit of that growth.

This is why many socialists around the turn of the twentieth century loved Georgism: it’s more than a tax scheme - it turns everyone into a landlord. And it’s why twenty-first century Progressives should take it much more seriously.

GK Chesterton famously said “The problem with too much capitalism is not enough capitalists.”

George would say, “The problem with too much landlordism is not enough landlords.”

But who is going to fix the heater in the winter?

Now when we said that landlords make $0, that wasn’t quite true. It was more of a rhetorical flourish.

Landlords still have a role to play in a Georgist society. But their incentives are realigned: they cannot profit off of the back of the community. They can only make money by providing services in the form of land improvements.

Recall that a Landlord makes money from their Property in two buckets: Land Rent and Improvements.

So a more accurate but less pithy table would actually look like this:

Okay is this socialism?

I mentioned before that William Buckley and Milton Friedman like Georgism. But aren’t they the most rabidly capitalist, anti-tax, anti-socialist people in the history of the world?

They are! But they approve of Georgism because it eliminates a hidden “drag” on the economy.

Let’s take an example:

Imagine, the teachers’ students struggle with a tricky concept in class. So the two teachers make some goofy flashcards to better explain the concept and it works - the kids finally get it!

Reveling in their success, one of the teachers says to the other: “Hey honey, you know those flashcards we made? I bet other teachers would benefit from using them. What if we made a bunch of flash cards and sold them for a small fee to account for our time?”

After doing this, they make $12,000 in extra salary after expenses. But a third of any income is paid in taxes, so they take home $$7,756.

Under Georgism, if their income goes up $12,000. They pay $0 in taxes so they take home all $12,000.

In the current system, some teachers will make flashcards and open source them out of the goodness of their hearts. But some will say, “Honey, that’s a great idea, but I don’t feel like paying the CA registration fee of $800 and then also only making $8,000 on this thing. It’s not worth it to me.”

Or take another example: the teachers love whitewater rafting. They could guide river trips for $12,000 every summer or they could take private trips themselves. If they take home only $8,000 out of $12,000 they may just prefer to go rafting on their own; lessening their incentive to share the joy of whitewater rafting.

That’s what eliminating the “drag” on the economy means. More flashcards get made. More river rafting trips happen. Everyone is better off: the teachers make more money, other teachers benefit from the flashcards, the children are smarter and can go river rafting in the summer.

However, raising taxes on Land causes no drag. In fact, it incentives more productive labor on the part of landlords because now they can only make money by improving their land.

What if the rents go boom?

Our teachers live in San Francisco where a technology boom led to skyrocketing rents. How would Georgism protect them?

Let’s say a boom drives the average Rent on Land goes up by $12,000 per year.

In the current system, the teachers’ rent would increase by $1,000 per month ($12,000 per year) and their take-home pay drops from $40,000 to $28,000. Landlords are $12,000 richer.

Under Georgism, the landlord’s rent tax would increase by $12,000 which they would pass on to the teachers so their take-home pay drops from $40,000 to $28,000. The government is $12,000 richer.

Under Georgism, booms cause public coffers to grow instead of private landlords!

So under Georgism when a boom makes a community’s land more valuable - aka more expensive - the citizen’s government will have more money with which to serve them.

This makes Georgism a powerful defense against displacement and Gentrification.

A quick review

By combining rent and tax into a single bucket:

At worst, the situation is neutral for the teachers: after rent and taxes they take home $40,000 either way. (I say at worst because recall that we expect land prices and rents to go down under Georgism).

The government is much better off as it doubled its revenue.

By extension the teachers are better off because the government can use that money to provide services for them or give them a subsidy on their rent.

The teachers are also better off because they can take home more of what they earn if they decide to work harder.

The teachers are more insulated from booms in their community because the floor automatically rises with wealth via the Citizen’s Dividend.

The children are better off because the teachers are more incentivized to guide river rafting trips and make flash cards.

Landlords are worse off as they do not get a private windfall simply by holding onto their land during a boom.

Landlords are better off because they get to experience the joy of working hard to make their community better instead of lazily sitting on their land and collecting rent for no work!