Imagining a simpler tax code on Tax Day

Closing loopholes and simplifying your taxes with the "Single Tax"!

If you live in the US, your taxes are due today! Which begs the question…

Why isn’t tax filing simpler?

Did you know that in many wealthy countries, most people don’t have to fill out tax forms at all? Instead the relevant parties like employers and banks report all the pertinent information on behalf of citizens and the government figures it out from there. Apparently, the US is perfectly capable of this as well.

So why don’t Americans have simple automated tax filing?

According to a damning ProPublica exposé, the answer is TurboTax:

“For more than 20 years, Intuit has waged a sophisticated, sometimes covert war to prevent the government from doing just that…

The company unleashed a battalion of lobbyists and hired top officials from the agency that regulates it…

Internal presentations lay out company tactics for fighting “encroachment,” Intuit’s catchall term for any government initiative to make filing taxes easier — such as creating a free government filing system or pre-filling people’s returns with payroll or other data the IRS already has.”

In the late 1990s, the US government came very close to creating simple, free electronic filing but was thwarted by Intuit’s chief lobbyist Bernie McKay who literally refers to himself as the “Darth Vader” of the tax prep industry.

You know who else loves complicated tax systems? Billionaires! The more complex the tax system, the easier it is to find loopholes and lobby for exceptions.

The Single Tax

Georgists were some of the earliest advocates for simplifying the tax code.

In the early 1900s, Georgists were known as “Single Taxers” because they insisted that we could replace all taxes with a single, easy to understand tax: the Land Value Tax.

Why? It seems kind of crazy today, but they believed in a simpler tax system for two reasons.

1. Land’s fixed quantity makes it the key driver of inequality.

As societies develop, a growing population chasing a fixed quantity of land drives prices up. This is pretty intuitive and it’s why real estate is always treated as such a sage investment.

But because we can never create more Land, this means that Land will take an ever rising share of the wealth that Labor and Capital generate - creating the heart-wrenching poverty we see in coastal US cities.

This is also why no matter how many generous policies we enact, everything just gets soaked up by rising land prices - making life more and more expensive for regular folks. Increase social security payments? It goes to land. Extend the Earned Income Tax Credit? It goes to land.

“When legislation expands incomes at the bottom, say by expanding the child tax credit or by raising the minimum wage without addressing the housing crisis those gains are often recouped by landlords, not solely by the families the legislation is intended to help.” Matthew Desmond in Poverty, by America

2. Land’s fixed quantity makes it the perfect thing to tax.

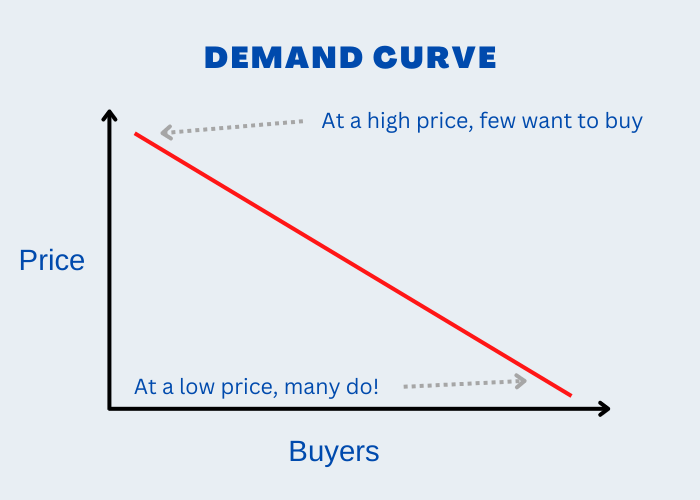

Generally, when you tax something you get less of it and it becomes more expensive.

If you tax wine, you get less and more expensive wine. If you tax income, you get less take home pay.

But since land is not produced, you don’t get less land by taxing it! If we were to shift all other taxes (income, sales, etc.) onto land then we would get more income and more buying and end up with the same quantity of land.

So far so good.

Okay but won’t land just get really expensive?

We’re used to the idea that raising taxes also drives up prices, but this is not so with land. Land taxes are one of the only taxes you cannot pass onto tenants.

Why?

Land has a market price. (Sure, your landlord may not be perfectly optimized to the market price and you have a sweet deal, but on the whole the market has an average price.)

If the average landlord could charge more to rent their land, they would already be doing it. Why don’t they?

Because demand for the land will drop if you charge more than the market price.

With other taxes, producers “pass the tax on” to consumers by raising prices and cutting production to account for reduced demand.

But since you cannot “cut production” of land, landlords must pay the tax even if no one is renting.

So a Land Tax turns out to be the perfect tax because it has none of the downsides of traditional taxes and cuts at the heart of inequality.

Who pays the Single Tax?

It’s fair to worry that a Single Tax might be regressive like a flat tax. But as Lars Doucet points out, the richest people own most of the land:

"Of all the real estate value in the United States, the top 1% own 14.7% of it, the top 10% own 44.8% of it, and the top 50% own 88.5% of it.”

Since many middle-class Americans own homes, it’s easy to forget that most of the valuable real estate is concentrated in places like Manhattan and San Francisco and owned by the super elite.

A Land Value Tax would target the owners of commercial real estate and downtown apartment buildings far more than the middle-class suburban homeowner.

Those who own no land, like many in the bottom 50%, would not pay any tax at all. No sales tax. No payroll tax. No income tax. No tariffs inflating the price of goods.

A single tax has no loopholes

Henry George championed the Single Tax during the Gilded Age because he wanted to address inequality.

Many Progressives witnessing the same inequality today valiantly advocate for a Wealth Tax.

But haven’t we all been around long enough to acquire a healthy cynicism about our ability to outfox the billionaires and their accountants? Raising taxes on income and capital gains seems like a surefire way to send more money to Turks and Caicos and other tax havens.

Since the wealthy own so much of the country’s valuable real estate, a Land Tax is like a highly enforceable Wealth Tax.

A Land Value Tax is difficult to game: Land cannot be moved into offshore accounts. And its simplicity leaves few places for lobbyists to carve out exceptions.

But won’t billionaires just buy less land to dodge taxes?

Well, would that be such a bad thing? Imagine how much land would be available for hardworking Americans to buy if the rich were actively disincentivized from holding onto land they don’t use as an investment.

Bill Gates is the largest owner of private agricultural land in the United States. Is that because Bill Gates is a badass farmer who is the best person to hold onto that land? No! He’s holding that land under the simple idea that scarce land always goes up in value.

Under a Single Tax, perhaps you could afford to buy that downtown storefront instead of renting from a landlord will raise the rent on you as soon as your business or neighborhood takes off.

(If you’re wondering if we can raise enough revenue via a Single Tax ask Lars Doucet and Mason Gaffney.)

Less time spent filing taxes

Ironically, TurboTax is currently running ads about how you can spend more time doing the things you love.

But if TurboTax got out of the lobbying game and we had a simple tax filing system, Americans would save 1.7 billion hours (5 hours per American) and $31 billion ($100 per American) per year.

Plus the psychic savings of never having to think about IRAs, 401ks, 403bs, 529s, HSA, FSAs, AMTs, SEP IRAs, and so on is priceless.

Imagine what a future April morning could look like under a Single Tax:

You wake drenched in sweat. It’s April 15th, 2030 - you forgot to file your taxes!

But then you remember that Georgism became the law of the land last year and you chuckle at how backwards things used to be. Grateful that you never need to look at a W2 or think about “withholding rates” again, you guiltlessly hit the snooze button.

An hour later you joyously bounce out of your luxurious sheets (acquired without sales tax no less). You brew some delicious free-trade coffee and fire up your top-of-the-line-but-cheaper-than-ever-before laptop (since all tariffs are now gone.)

You pull up the Local Times (local journalism is again flourishing because the Citizen’s Dividend and less wasteful land use means local journalists can finally pay their rents).

You check the stock market and see that it is booming (since there are no taxes on corporations). Good thing you had that extra $150,000 to invest (since down payments dropped 75% since the implementation of Georgism!)

You quickly log into Etsy and see that your googly eye pet rock side-hustle is profiting nicely (with all of this extra cash in the pockets of consumers). And you smile as you realize that every dollar coming in is precious profit for you and your family (with the elimination of the income tax).

You feel a little guilty about your capitalist greed, until you remember that your state’s last homeless shelter shut down last month because every single person now has their own place to live and a universal basic income!

Until then, Happy Tax Day!