Will the rent go up or down under Georgism?

My friend, Cody, is curious about Georgism. But he wondered about this point: “If we tax away all the value of land, why would my landlord invest in a necessary $80,000 paint job for our house?”

And more generally, I get a lot of questions about what happens to landlords under Georgism. Do they still exist? Does the government own all land?

And finally, many of us are here because the RENT IS TOO DAMN HIGH. We want to know: Do rents go up or down under Georgism?

Fortunately, all three of these questions are intertwined. So by answering one we should be able to answer them all!

What happens to rent under Georgism?

Let’s start with an example: There is a property near us that is worth $2.4M and it has 3 units. Let’s say today each unit rents for $3,333 per month or $40,000 per year and Alfie owns this building.

What would happen to Alfie’s building under Georgism?

First, we need to determine the Land Value Tax Alfie owes on this property. This is done with a simple equation:

Property Value * Land Share * Capitalization Rate

Remember that Land Share ranges between 50% and 81% of a Property’s total value. Let’s assume that Land is 75% of a Property’s value and Improvements represent 25%. This means that this building is worth $600,000 and the Land is worth $1,800,000.

The Capitalization Rate is the amount of annual income that a piece of property can generate by virtue of its location. Recall that estimates vary between 5% and 10% of the total property value. Here we’ll split the difference and say it’s 7.5%.

Now we can estimate the amount that this property is capable of generating solely by virtue of its location and proximity to other things like businesses, restaurants, parks, schools, public transit, etc.:

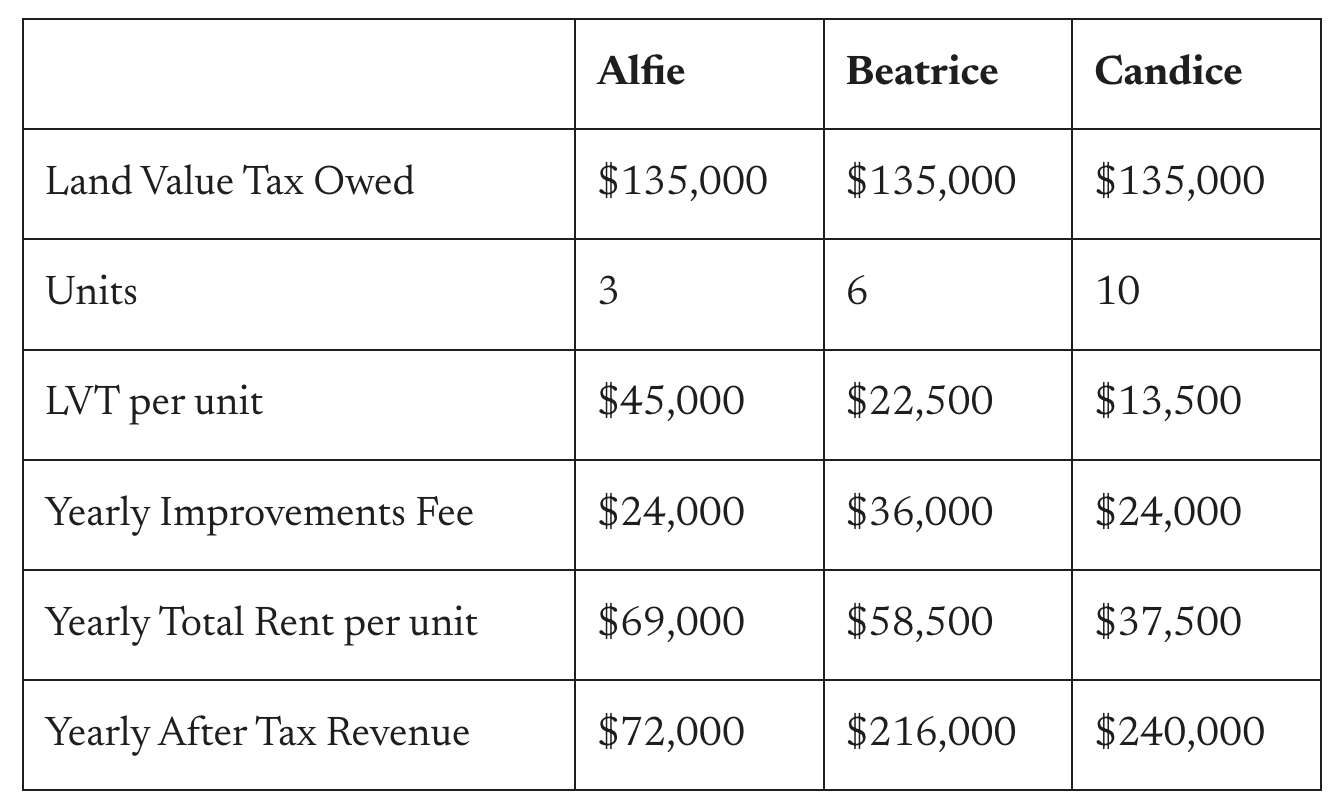

Property Value ($2.4M) * Land Share (75%) * Capitalization Rate (7.5%) = $135,000.

Under Georgism, Alfie owes $135,000 in taxes to keep his building on this land. This is because that is the amount of value that is generated by the community, not by Alfie’s hard work.

Now, let’s figure out the rent Alfie will charge.

Alfie will divide the tax across all 3 units, making the rent at least $45,000 per year for each unit.

But Alfie needs to make more than that in order to go through the trouble of managing the property!

Fortunately, Alfie is a good and kindly landlord. He installs radiant heating in the floors and is quick to answer calls from tenants about leaky faucets and broken air conditioners. Because of these improvements, Alfie can justify an additional $2,000 per month for each unit, or $24,000 per year.

Therefore, Alfie will charge rent equal to the Land Value Tax ($45,000) + an Improvements Fee ($24,000) for a total of $69,000.

But didn’t I say the rent today was $40,000 per year? That means the rent has actually gone up under Georgism! What gives?

Rent increases are offset by tax reduction

Remember that Georgists want to replace all other taxes with a Land Value Tax. So the renter of this unit pays $0 in tax.

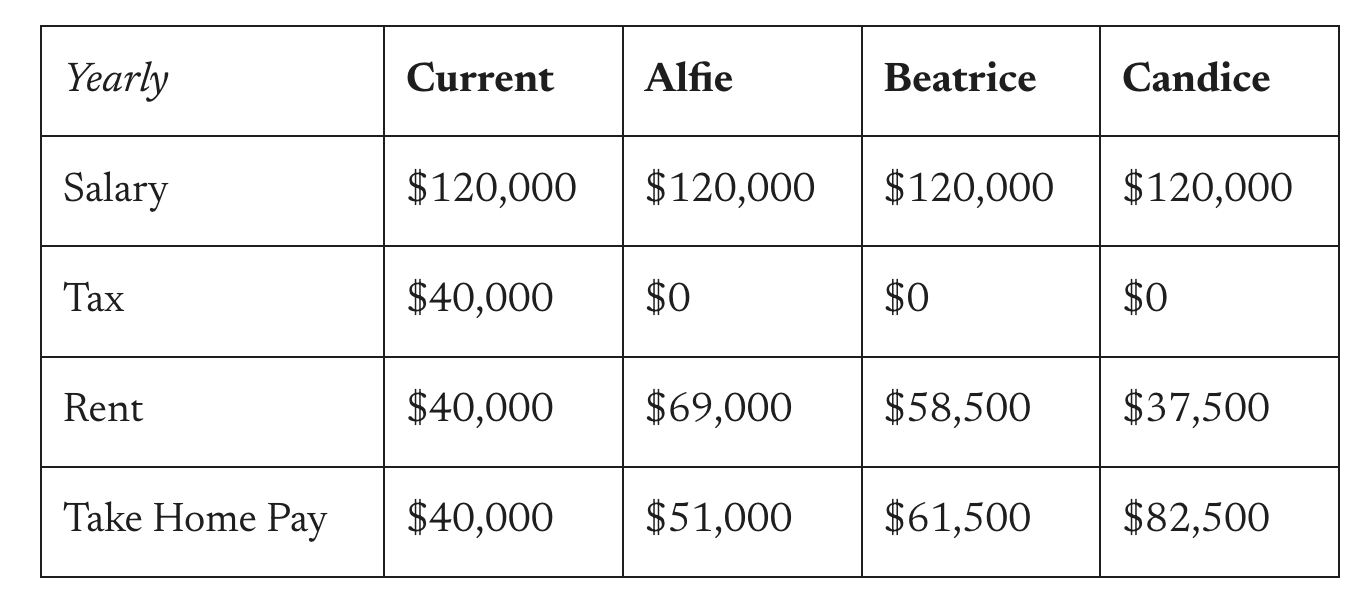

In a Medicare for All, but for Land we talked about two teachers in San Francisco. Say they want to rent this unit. Under the current system they make $120,000 pre-tax, pay $40,000 in tax, and $40,000 in rent. So they take home $40,000.

Under Georgism, they make $120,000 pre-tax, pay $0 in tax, and $69,000 in rent. So they take home $51,000.

So while their rent does increase, their take home pay has gone up by $11,000 under Georgism!

Since renters take home significantly more money without income and other taxes, it makes sense that rents would rise. However, the renters are better off for two reasons:

The efficiency of combining rent and tax means they take home $11,000 more per year

The government takes home $45,000 instead of $40,000 meaning the renters get better public services

But the story doesn’t end there!

New incentives will lower rents

Let’s say Beatrice owns the building next door to Alfie. Since it’s next door to Alfie’s property, Beatrice owes the exact same Land Value Tax: $135,000.

But Beatrice’s building has 6 units. So the per unit Land Value Tax drops to $22,500.

In friendly competition with Alfie, Beatrice goes all in on improvements. She adds double paned windows, brand new appliances, granite countertops, and a sauna in each unit. She also invests in that $80,000 paint job so the house is sparkling!

Because of these investments, Beatrice can charge a higher Improvements Fee of $3,000 per month or $36,000 per year.

Despite the fact that Beatrice’s units are 50% nicer, she charges only $58,500 per unit compared to Alfie’s $69,000.

And amazingly, Beatrice makes much more profit: $216,000 compared to Alfie’s $72,000.

Which landlord would you rent from? Beatrice of course! You can pay less for better quality.

Alfie has three choices:

He can reduce his Improvements Fee and compete on price

He can add more units to compete on price

Or he can improve his units to justify a higher Improvements Fee

All of these are good news for renters! Georgism creates a virtuous cycle of ever increasing quality at lower prices!

But won’t this just lead to luxury housing?

Savvy readers have seen neoliberal promises broken before. What’s to say our neighborhoods won’t be filled with Sterile Luxury Eyesores?

Let’s say Candice owns a third parcel of land on the same block as Alfie and Beatrice. Imagine Candice says, “I don’t have the aesthetic skills that Alfie and Beatrice have. I can never compete with them on luxury so I will compete on price.”

Candice builds a 10-unit building next door. She also owes $135,000 in tax per year for her parcel of land, but spreads it over 10 units. The Land Value Tax drops to $13,500 per unit. Candice can match Alfie’s $24,000 per unit per year Improvement Fee and charge a total of $37,500 in rent.

Despite charging nearly 50% less rent than Alfie, she is making 3x the profits!

Georgism incentivizes landlords to build more units which lowers prices. Yes, some landlords will invest in luxury but many others will invest in density in order to maximize their returns. So we expect downward pressure on rents.

Why won’t the landlord raise the rent to cover the tax?

This question deserves and has its own article: Why can’t landlords pass the tax onto tenants?

The short answer is that landlords need to pay the tax, even if no one is renting it. If they raise the rent above the market rate to cover the tax, fewer people will rent from them and they will make less money. But their tax bill does not go down simply because no one is renting it. It's kind of like a vacancy tax.

So will we still have landlords? And will they invest in their property?

Now we can answer our three questions from the beginning of the article:

1. Will landlords still exist?

Yes! As this example shows, there is still a tremendous amount of money to be made from being a landlord. You just have to work for it by improving and managing an awesome building. Gone are the days of landlords sitting around and letting rents rise and free-riding on booms in their community.

Under Georgism, the government does not own the land. Hard working people do. Landowners just pay taxes in order to use land and pay their fair share to their community.

2. Do rents go up or down?

We have also seen that there are two counterbalancing pressures on rent under Geogrism.

First, because of the elimination of other taxes, rents will rise somewhat. However, because of the efficiency of combining rent and tax into one bucket, take home pay should rise for most ordinary people. And now, rising Land values correspond to rising tax revenue and improved government services. So the overall effect is positive for renters.

Second, because of improved incentives for investing in the supply of housing, we would expect rents to ultimately go down.

3. Why would landlords invest in their property?

Hopefully the answer is now clear: in fact, the only way that any landlord can make any money under Georgism is by investing in their property. This is because the only profit that the landlord makes is that Improvements Fee. Everything else is taxed away and shared with the community.

And remember that there is no property tax under Georgism. So the more that landlords invest in their properties, the less tax they pay relative to revenue.

A Win Win Win

Hopefully this example has shown that renters are better off under Georgism because they have more money in their pockets and get better public services.

To wrap up, let’s return to the example of the two teachers living in SF from above. Here’s what they would pay in rent and take home from each of the three landlords:

In another article, we’ll look at the teachers' options for buying a home under Georgism. But we can see that in every case, renters take home more under Georgism than they do today.